Gilbert Tax Lawyer

Gilbert Tax Lawyers Fight to Protect Your Rights and Minimize Your Liability

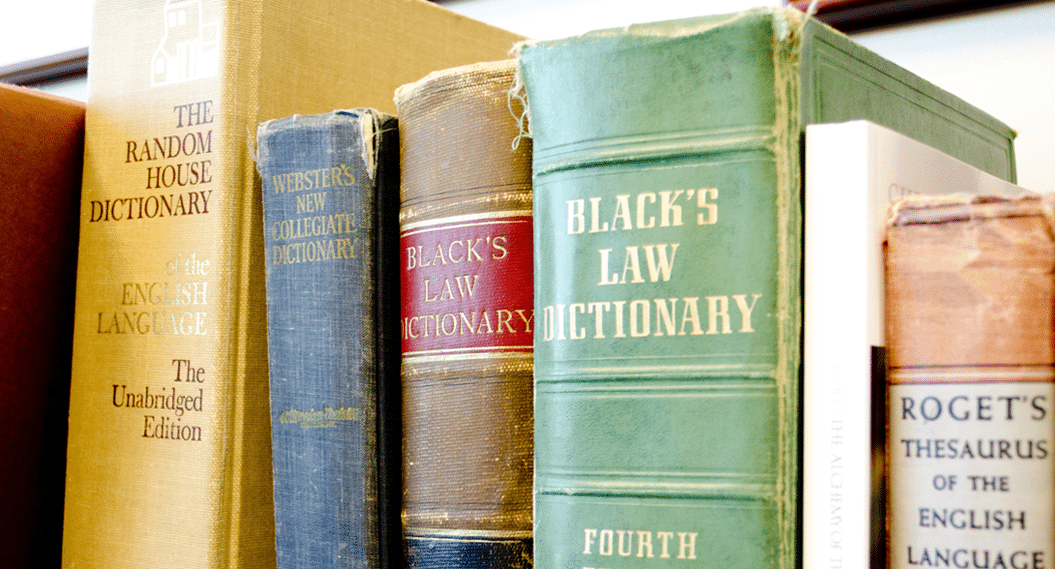

You need an experienced Gilbert tax lawyer to represent you when the tax man comes calling. Whether it’s a “simple” audit or a lawsuit, the stakes are too high to try to handle the matter yourself or to hire a lawyer who doesn’t have the right skills and experience. The attorneys at Silver Law PLC in Arizona have both. Our attorneys have more than 80 years of combined experience among them, and they have worked as prosecutors for the Internal Revenue Service, giving them special insights and skills to provide a stronger defense for our clients.

Tax Audit Representation

Tax audits often inspire dread – and for good reason. Sometimes, a simple flag can trigger a tax audit, such as you claiming a home office space. But the audit will take a closer look at what you have reported, and if there are any mistakes, you could end up owing more money or having to pay a penalty. Even if you did not intend to deceive on your tax return, it is very easy for the IRS to find some discrepancy and to penalize you. A Gilbert tax lawyer from our team can represent you during your tax audit to protect your legal rights and to minimize your liability. Your tax lawyer will find all the deductions and credits you can take, will help you put together the proper documentation for everything you’ve claimed, and will create arguments for why you qualify for certain exceptions. The goal is to turn the audit in your favor and to keep you from getting yourself in any trouble.Silver Law PLC

Servicing: Gilbert, AZ

Tax Collections

Even with your best efforts to reduce your tax liability and to pay your taxes on time, you may find yourself in serious debt to the IRS. Instead of allowing collection efforts to continue and to risk your home or other assets, you need to work with one of our Arizona tax collection attorneys to negotiate a settlement or even get your debt dismissed.Innocent Spouse Relief

Unfortunately, your spouse is not always as honest with you as you believe. Your spouse could be intentionally lying on your tax return or even hiding assets from you, including investments, income, or property. You may not know about these assets or the fraud, but the IRS will certainly find out about them. When the IRS comes calling, you won’t be able to claim ignorance and get off the hook. You need a Gilbert tax lawyer who can help you apply and qualify for innocent spouse relief. You can claim that you didn’t know about these assets or reporting mistakes, but you have to meet specific criteria to prove it and to be considered separate from your spouse in the matter. Your tax lawyer will help you do that.Foreign Tax Reporting

You must report all income and interest earned on your taxes, no matter where you earned it. If you fail to do so, you can face severe fines and penalties, including jail time. Our tax lawyers can help you understand your obligations for foreign tax reporting and the offshore voluntary disclosure initiative. These laws cover accounts and assets that you currently hold overseas, as well as previously undisclosed assets. We’ll help you meet your reporting obligations while also finding ways to reduce your liability.Tax Litigation

Litigation is the most serious tax issue you can face. Our tax attorneys represent individual and corporate clients in criminal and civil tax litigation. We fight to help you avoid serious repercussions, including large levies, asset seizure, criminal conviction, and more. We have successfully litigated and defended cases for clients dealing with all types of tax issues.Extremely Professional!

Ken S. – Tempe

“ If you have any kind of Tax issue and don’t go here you are making a mistake.”

Great Guidance!

Nancy M. – Gilbert

“Jason was most helpful and professional throughout our IRS audit experience. We would recommend him for your needs.”

Related Posts – Silver Law PLC

Company Found In Contempt Of Court For Refusing Subpoena Regarding Dual-Purpose Communication

Company Found In Contempt Of Court For Refusing Subpoena Regarding Dual-Purpose Communication Sometimes, attorneys find themselves wearing multiple hats, acting ...

Paycheck Protection Program Loans: Expenses Paid are Not Deductible

Paycheck Protection Program Loans: Expenses Paid are Not Deductible Many businesses have had to close or move their operations online ...

Taxpayer Advocate Service Issues Report on Tax Credit, Creates Map of Taxpayers

Taxpayer Advocate Service Issues Report on Tax Credit, Creates Map of Taxpayers The Taxpayer Advocate Service (TAS) issued a report ...

Tax Penalties and Why You Should Pay on Time

Tax Penalties and Why You Should Pay on Time No one likes paying their taxes – well, you’d be hard ...

When Does Tax Litigation Require the Assistance of a Business Firm?

When Does Tax Litigation Require the Assistance of a Business Firm? Much like doctors, lawyers often specialize in different fields ...

How Bankruptcy Affects Tax Liens And Repayment Schedules

How Bankruptcy Affects Tax Liens and Repayment Schedules Taxes take a huge chunk out of our incomes. Some of us ...

When You Need a Tax Litigation Firm Instead of a Commercial Litigation Firm

When You Need a Tax Litigation Firm Instead of a Commercial Litigation Firm Running a business brings with it a ...

Passport Actions Under Section 7345

Passport Actions Under Section 7345 The Internal Revenue Service issued new guidance for handling passport actions related to tax debts ...